Introduction to Charitable Remainder Trusts

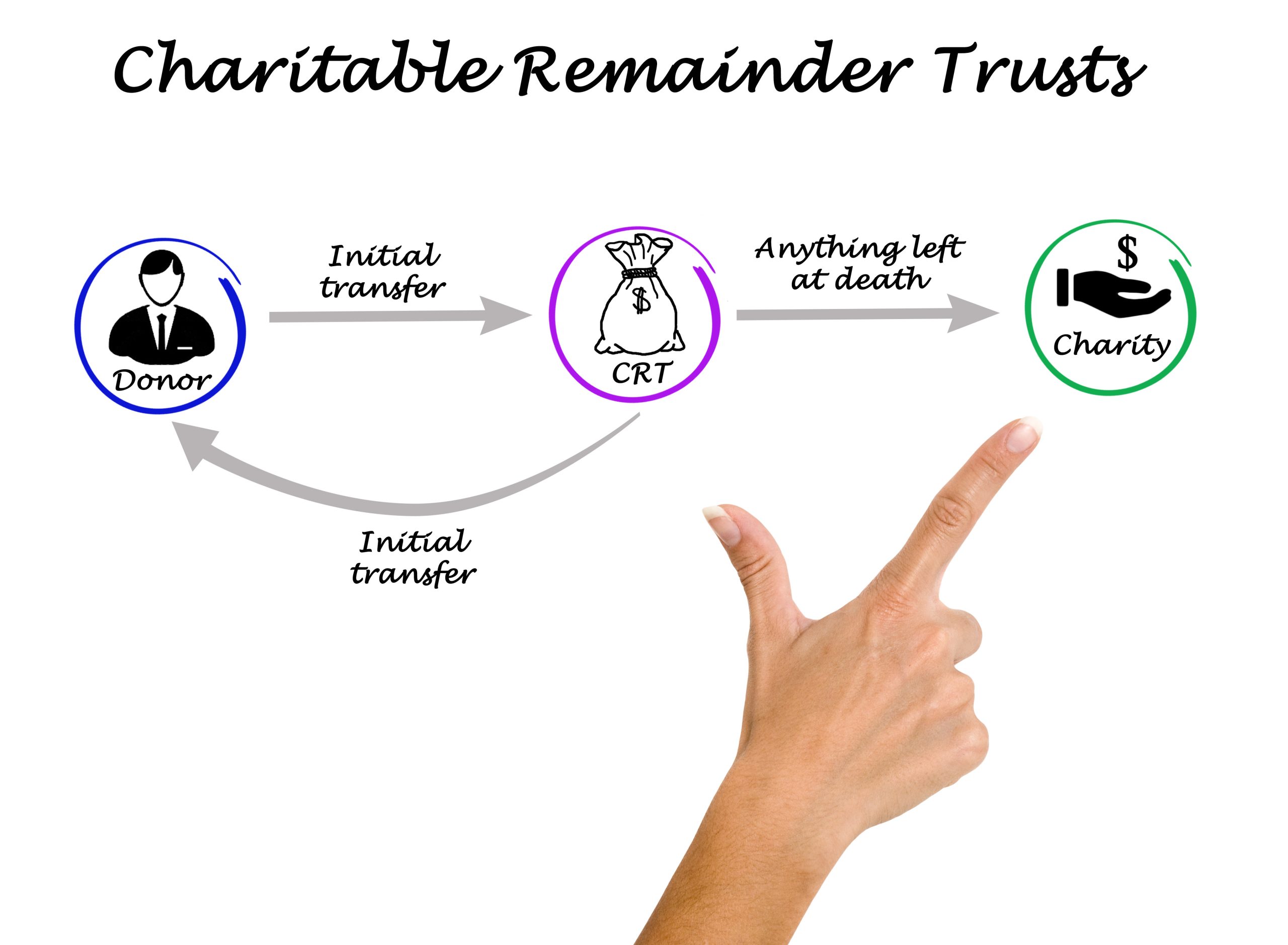

Charitable remainder trusts are complex financial instruments that allow an individual or organization to set aside a portion of their assets to benefit a charity or cause while still benefiting from tax breaks and other advantageous terms. The trust is structured so that the assets within it can generate income for the beneficiary during their lifetime or after death. The remainder left over after all expenses are paid out is then distributed to a designated charity upon the termination of the trust’s term.

So How do they Work?

When setting up a charitable remainder trust, an individual or organization will transfer assets (usually cash or securities) into the trust, with instructions on how those assets should be managed Reviewed By a trustee (who is typically not affiliated with either party). The trust then invests in assets that generate income for its beneficiaries, usually through interest accrued on investments such as bonds or stocks. This income is then distributed among one to four individuals according to predetermined rules outlined in the trust agreement. When all expenses associated with managing the trust have been paid out, any remaining funds are transferred to designated charities at the end of the term specified in the trust agreement.

Advantages of Exploring CRTs:

Numerous advantages are associated with using charitable remainder trusts as part of an estate plan or investment portfolio. First, these trusts can provide significant tax benefits depending on how they are structured—for example, avoiding capital gains taxes when transferring appreciated assets into a life-income gift fund, reducing estate taxes, and potentially reducing taxable income each year due to deductions from contributions made from annual income to qualified charities listed on IRS Publication 78 (which can also qualify for matching grants from corporations).

Additionally, these trusts can provide steady income during retirement years while generating philanthropic impact through donations made at death; they can also be used as an alternative vehicle for donating large sums of money without having it count against your estate; and finally, they offer asset protection against creditors since any transfers into them cannot be challenged once established.

Important Considerations for those Considering a CRT:

When creating a charitable remainder trust, you should consider several factors such as current and future tax laws, whether you want any remaining funds after the termination of your lifetime benefit transferred directly upon death or held in perpetuity or whether there may be special provisions such as allowing more than one beneficiary access to different portions of the same fund.

(If that sounds like a lot, don’t worry we’re here to help)

Other considerations include if you would like access to principal funds during your lifetime, what type(s) of investments should be held within it; and who will serve as trustee/administrator of your trust.

Finally, any gifts made through the trust meet applicable IRS guidelines regarding charitable organizations and non-profits before being eligible for tax deductions—not every non-profit qualifies under IRS guidelines, so make sure you understand what’s required before establishing one!

FAQs

Here are a few of the most common questions we get when our clients begin the CRT process with us:

What types of assets can be included in my Charitable Remainder Trust?

Generally speaking, almost any asset can be placed into a CRT, including real estate, stocks, bonds, mutual funds, and more. However, certain property types may not be eligible depending on their source or structure, so it’s important to consult with your advisor before transferring any asset into your trust.

Can I avoid paying capital gains tax if I use a Charitable Remainder Trust?

Technically, the trust avoids capital gain taxes when it sells appreciated assets since it is considered a tax-exempt entity. However, donors can benefit from this arrangement through reduced estate and capital gains taxes when they transfer their assets into the trust.

Are all Charitable Remainder Trusts the same?

No, there are two main types of CRTs: charitable remainder annuity trusts (CRATs) and charitable remainder unitrusts (CRUTs). A CRAT pays out a fixed dollar amount each year, while a CRUT pays out an amount based on a percentage of its value annually. Depending on your specific situation, one type of trust better suits your needs than another. Therefore, it’s essential to consult an experienced attorney or financial advisor before deciding which type of trust best suits your needs.

Who benefits from a Charitable Remainder Trust?

A Charitable Remainder Trust offers numerous benefits both to donors and recipients. Donors have access to tax deductions and can benefit from passing their assets on to charity free of capital gains taxes. Recipients benefit from receiving regular income based on their donated asset’s value over time, thus avoiding incurring capital gain taxes when selling it themselves.

Since CRTs are managed Reviewed By trustees experienced in finance and taxation law, recipients don’t have to worry about calculating and reporting their income each year as long as they provide sufficient information about their assets to the trustee annually.

Who should consider an ATS Charitable Remainder Trust?

Individuals with significant assets, such as $250,000 or more, who want to provide for charitable organizations in a tax-advantaged way should consider setting up an ATS Charitable Remainder Trust. Additionally, those who wish to retain some control over their assets even after passing away may find the CRT an attractive option.

*Important Disclaimer

ATS is a financial advisory firm that helps clients understand complex matters such as estate planning, trusts, and charitable giving. While we are not attorneys or tax advisors and do not give legal or tax advice, we can work with our client’s existing legal and tax teams to provide a comprehensive approach to helping them plan their estates.

We are happy to help educate clients on CRTs, so they fully understand their options and create strategies that work best for their situation. However, it is important to note that any decisions should involve input from legal or tax advisors to ensure that all regulations are followed and that applicable laws or regulations are considered.

If you have questions about creating a CRT, our team of experts is here to help guide you through the process.